Acquires customer support tools helped us qualify issues faster, provide more efficient help and reduce resolution time.

Elevate wants to help Americas new middle class build better financial futures. To help make its mission a reality, Elevate chose Acquire, a conversational customer experience platform that bridges the gap between support teams and the customers they serve. With Acquire, agents are able to reach more people, faster, whilst raising the bar on customer service.

The team at Elevate cares deeply about providing great experiences even in hard times. Elevate offers tech-enabled credit solutions that support the financial wellness of the millions of Americans who live paycheck to paycheck. One of its most beloved products, Rise, provides personal loans with flexible terms, credit bureau reporting, and interest rates that go down as customers make more payments on time.

When dedication to customer support becomes a (burden)

A quick look at its website reveals the massive impact Rise has on the lives of customers and their families. Take Jennifer, a single mom of three who recently had to file for bankruptcy. As she put it, Lenders wouldnt even give [her] a second glance. Traditional payday loans, on the other hand, cost her too much and posed a risk to her credit.

In Rise, Jennifer found a second chance. Quick access to loans all but eliminated the threat that unexpected expenses once posed to her family of four. Better yet, as Jennifer continues to make payments on time, her interest rates decrease and her credit score rises, which has incentivized her to learn more effective budgeting practices.

Jennifers is not a story of unlikely or one-off success. Providing (quite literally) life-changing experiences for customers is Rises bread and butter. Thats why Rise chose Acquire to keep the bar for service extremely high whilst still ensuring the capacity to help as many customers as possible achieve financial wellness as soon as tomorrow.

Before Acquire, Elevate had a resource-intensive process that yielded little feedback

Elevate is dedicated to helping their customers through some of their toughest times, and therefore dont take customer support lightly.

In fact, Elevate bypasses some traditional customer support metrics, such as agent on-call time, because theyre focused on outcomes and issue resolution.

This dedication to thorough customer service started to become hard to manage without the proper tools, though.

Each time a customer called in, there was no way to tell if the session was going to be work intensive or not. This meant that additional customer support time was needed to assess the situation and direct a caller to the right resource or support agent.

Elevate also had no way to track the effect that customer support calls had on the signup process. Similarly, they had no way to track which point in the application process caused the most customer issues. These two factors combined to make a customer support arm that had no way of measuring their impact or pinpointing areas of improvement.

Creating a seamless experience in urgent situations

Unlike those of a traditional brick-and-mortar bank, Rise agents regularly receive calls and messages from customers under extreme duress, so any customer support solution they adopted needed to be up to the task of assessing complications in seconds instead of minutes, to help people find the funds they need faster without putting any strain on the customer.

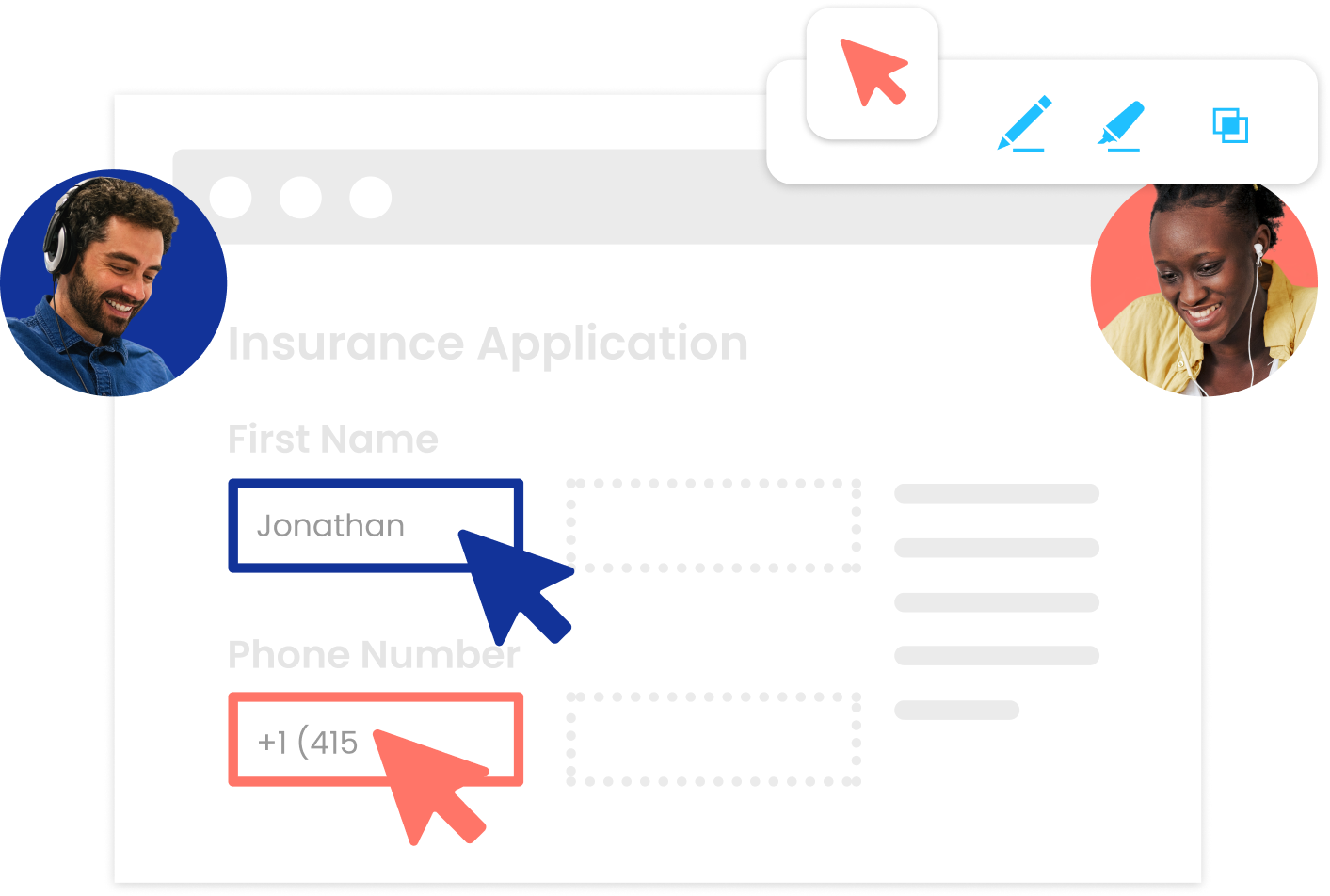

Acquires live chat and cobrowsing products work in tandem together to help Rise achieve its mission in eliminating barriers between customers and the support agents who want to help them. Regardless of whether they log on through mobile or web app the user-friendly chat interface can be accessed anywhere on the Rise site. If a customer gets stuck, agents can then offer to initiate a cobrowsing session instantly from a live chat, allowing them to see and interact on-screen together in real-time.

Live chat gives more reach

If sending a chat feels less burdensome then picking up the phone or composing an email, live chat makes customers feel more comfortable to reach out to support agents with quick questions.

Rise project manager, Raquel Wilson, is excited to see how live chat empowers more customers to ask for what they need.

In my experience, when Im at work and I need to talk to my internet provider or cable company about a problem I have, I am much more likely to do it over chat. For one, I dont want to make everyone in the office listen to me talk on the phone. Plus, it typically doesnt take as long.

For Rise customers, who may feel even more nervous to talk about sensitive financial matters at work, live chat can be different in seeking help or not. Live chat gives Rise much more reach, says Raquel. Collection customers, for instance, are more likely to reach out to you over chat than over the phone. If youre in a tough spot, that conversation may feel more comfortable over chat than over the phone. So that new channel to reach out customers is going to be huge for us.

Enabling one-touch resolutions with Cobrowse

The biggest challenge for agents is not being able to see what their customer sees. They have to base recommendations off of the customers description of the problem rather than their own assessment. In combination with live chat, cobrowse will allow us to see exactly what needs fixing, without requiring the customer to take a screenshot and email it to us, which is time-consuming and not effective, explains Raquel.

Because Acquires cobrowsing makes it easier for Rise agents assess customer problems, they can stay laser-focused on their ultimate goal: help as many customers as possible, while always remaining upbeat, courteous, and kind.

Customers dont need to leave the site to download any external application or launch a separate video meeting. They simply accept the agents request that appears automatically in a pop-up window. With cobrowse, as opposed to full-screen share, only the users browser tab is shared, as well as masking sensitive fields such as credit card details - this ensures security and privacy compliance which is an essential requirement for any financial enterprise.

Once initiated, agents then have a window to identify where the customer is struggling and can use highlight and draw features to indicate exactly what steps they need to take next in an application or account page. They can also navigate on behalf of the customer to specific pages or account locations - all within the first interaction and without burdening them with an onslaught of questions.

After Acquire

Acquires tools have revolutionized Elevates customer support process and analytics. On the agent side, live chat makes it simpler and less time-consuming to answer the little questions that may come up for, say, a returning customer that needs their password reset before they can make a payment on their loan. This frees up agents to spend their time on the phone with customers who need more context on the process or who have a more technical problem to fix.

In combination with live chat, cobrowse will allow us to see exactly what needs fixing.

- Raquel Wilson

Rise Project Manager

Agents are also able to hold more than one conversation at once, which allows the same number of support representatives to assess the needs of multiple users at once and serve more people in the same amount of time. Agents can also transfer the customer to a more specialized agent if needed, without any disruption on the users end.

Elevate has also been able to implement a Tiered Agent Permissions program. During onboarding, new agents may be limited to live chat, while more experienced agents can use the entirety of Acquires tools.

On the product side, Acquire has empowered Elevate to assess the impact of customer support and where customer issues arise. With Acquire, Elevate will be able to measure how many applicants interact with their widget/support team and those that then went on to complete applications. Feedback will also be sent to users automatically so that they can more easily capture results and can customize in various stages of their customer lifecycle and application process. Lastly, Elevate is able to understand where in the application process customers have the most issues as they can see what pages they receive the most chats or requests from.

Even before Acquire, the Rise support team prided itself on keeping wait times low for customers, while still making sure they answered every question and solved every problem for the customer before they hang up. That means every agent has to be knowledgeable and efficient. With live chat and one-touch cobrowse at their disposal, agents can now even more efficiently answer customer questions and dedicate more time and energy towards harnessing their deep knowledge of the Rise product to change customers lives.